New Research: Affluent prospects classify their financial advisor’s sales process.

Seattle

“It makes sense, and you’re right, it is a bit counterintuitive, even though the affluent don’t like sales people, they still expect you to sell them on your services.” Dean pointed out as a prelude to his question, “But how do you know when you’re being too salesy?”

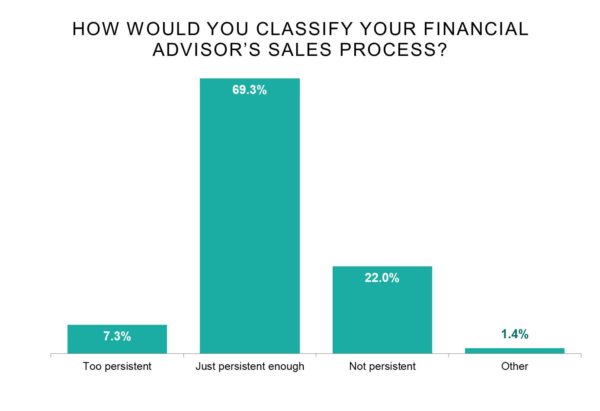

Ah-ha! Dean just asked that $10 Million Question — how does a financial advisor walk that fine line with an affluent prospect between being too aggressive or too passive? Before getting into the answer, let me share with you our recent research on how today’s affluent categorized their financial advisor’s sales process. (Keep in mind, this is the financial advisor who successfully converted their prospect to a client.)

Now you can understand where Dean’s question is coming from. Nearly 7 out of 10 affluent prospects said their financial advisor’s sales process was just persistent enough. Whereas 22% said their financial advisor wasn’t persistent at all. As I explained to Dean, the first takeaway is that a non-persistent sales process was 3 times more effective than one that was too persistent (22% vs 7.3%).

In other words, the affluent DO NOT like pushy sales people. My first coaching tip for Dean was simple; if you’re known as an aggressive sales person, dial it down and go passive. I could tell by the look on his face, he wanted the secret formula for being just persistent enough. Like many advisors, Dean was good with numbers and quickly determined that financial advisors who were persistent without being pushy were over 3xs more effective than their more passive counterparts (69.3% vs 22%) and over 9xs more than those who were too persistent.

Here are the tips I shared with Dean in the hotel lobby following my speech. As I explained, these three components are inextricably linked.

3 Components of Being “Just Persistent Enough”

1. Ask Questions

Most advisors enter various situations, ready to find the next business opportunity. They’re basically ready to sell – to talk about themselves and their business. This not-so-subtle approach to uncovering new opportunities ends up activating people’s sales antenna. Make the conversation about them, not about you. Ask general rapport-building questions about the person with whom you’re speaking. Ask about their family, work, personal interests, etc. When it flows with the conversation, you can subtly begin to ask questions that have a small dose of business implication… “Are you planning to play a lot of golf in retirement?” You get the picture.

2. Listen

Apply the 80/20 listening rule. This is where you’re talking only 20% of the time, mostly by continuing to ask questions, and spending the rest of the time — 80% — listening. It’s important that you’re a proactive listener, as this skill is what will enable you to phrase questions in the moment that are relative to what you’re hearing. Nothing is worse than pretending to listen, and then asking questions you’ve prepared in advance that aren’t relevant. More often than not, your affluent prospect is going to tell you how to sell your services, relative to their situation.

3. Mini-close

Essentially, the ability to mini-close is what separates the not persistent and just persistent enough. What’s a mini-close? Just what it appears. You make a suggestion to further discuss or assist with a financial-related matter that they mentioned to you in conversation. Your goal is for the prospect to take you up on the offer.

This can take the form of, “Let’s grab a cup of coffee and go over this.” to “Can I make a suggestion, why don’t you come to our office where we can take a thorough look at everything?” to “Let’s get this paperwork out of the way so we can get started.”

The mini-close is based on human psychology; you make a suggestion, they comply, you make another suggestion, they comply. This establishes a subtle cause and effect pattern where, according to affluent prospects, you’re just persistent enough.

Being persistent enough without being pushy is an art that requires self-awareness, discipline, and practice. Dean’s first step is to determine whether he’s not persistent or too persistent (he claimed not persistent). So, whether you need to dial it up and master the mini-close, or dial it down and learn how to listen and conversationally ask real-time questions — all three components are important.

For those who are serious about mastering this fine art, I’d highly recommend role-playing with another advisor, making certain you both get good feedback.

Today’s affluent prospects have spoken. They want you to have sales skills that are seamless — for you to offer your help and expertise without making them feel like they’re in a high-pressure sales situation. Take these three components to heart and my bet is that you’ll master being just persistent enough.

Want to see more of our research data on the affluent? Get access to all of our research reports and infographics, PLUS our most popular webinar series on demand by subscribing to our Course Library today!