We’ve been studying word-of-mouth influence (WOMI) in earnest since 2003 when our affluent research identified it as a “significant impact factor” in major purchase decisions. Over the past 14 years, we’ve witnessed the power of WOMI become the dominating trend in affluent marketing. However, because of its nuanced nature, we discovered that identifying the cause and effect was far more challenging. It was extremely difficult to determine what stimulated WOMI.

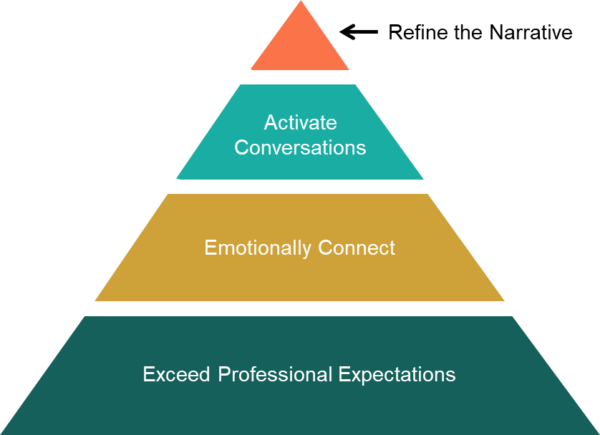

Our persistence on this issue has finally born fruit. Our recent research on financial advisors and WOMI uncovered a pattern that under close inspection brought clarity to what we had been studying. Once we were able to compartmentalize all the actions of advisors who were the beneficiaries of WOMI, a sequential model evolved (see below) that we’ve labeled…

As with all models, the objective is to simplify something that tends to be complex, or in this case, has many shades of grey.

Using financial advisors as our subject, we measured WOMI using a simple, but powerful metric: the number of unsolicited referrals an advisor received in the past 12 months. The advisors benefiting the most were getting 10 or more referrals annually and bringing in significantly more new business (nearly twice as many new clients and assets) as a result.

- Generators: 73% 10+ new HHs; 46% $10mm+ new assets

- Middlers: 42% 10+ new HHs; 26% $10mm+ new assets

- Laggards: 17% 10+ new HHs; 13% $10mm+ new assets

Let me introduce you to the components that make up our hierarchy and provide a brief overview of each.

Exceed Professional Expectations: Being an outstanding professional is the baseline for word-of-mouth-influence.

A financial advisor must be “first rate” in every sense of the term. He or she must know the financial landscape inside and out, understand the needs and expectations of affluent clients, be client-centric and consistent, and ensure every team member exudes a similar level of professionalism. Effectively, exceeding professional expectations has become a hygiene factor regarding WOMI — it’s both expected and essential.

This goes beyond comprehensive wealth management services and includes the quality of personalized service, the quality and frequency of in-office reviews and ongoing communication, the use of outside experts, as well as following through on all promises.

Emotionally Connect: Emotionally connecting creates a reciprocal, caring relationship.

One might assume that if a financial advisor exceeds professional expectations, the word will get around. Not necessarily. Why? Because professionalism is expected.

Herein is a major reason why the majority of financial advisors do not benefit from WOMI. They might be doing a good job professionally, but if they fail to realize the importance of emotionally connecting with each of their affluent clients, they will fail to reap the benefits of WOMI.

For the past decade, our affluent research has identified the importance of financial advisors expanding client relationships to include a personal element. Whenever this has occurred, clients rated their advisor’s performance higher in every area of wealth management. They talk about them, provide unsolicited referrals, and are also more willing to personally introduce their financial advisor to people in their spheres of influence.

When the advisor/client relationship has transformed in this manner, you’ve built the foundation for an emotional connection. HBR ran an article by Alan Zorfas and Daniel Leemon titled An Emotional Connection Matters More than Customer Satisfaction where they claim these “customers are twice as valuable, follow your advice, recommend you more…” To paraphrase, they are ideal clients.

What is emotionally connecting? Essentially it’s bonding with another individual on a personal level, which entails sharing feelings and thoughts. Much like you would with a close friend. This requires advisors to have a sincere interest in their client’s family issues, talk about these issues with the client, and reciprocating by sharing personal issues regarding their family. These heartfelt conversations occur most naturally in social venues outside of the office.

It seems as though many financial advisors assume that asking a few family questions at the end of a client review covers them in this regard. Not so. This is only true if they’ve already begun emotionally connecting by engaging the client in these personal conversations in a non-business setting.

When an emotional connection exists, caring is reciprocal and word-of-mouth influence is natural.

Activate Conversations: Create situations where it’s natural for clients to talk about your services.

Financial advisors who mostly benefit from WOMI don’t wait for clients to stumble upon the right situation — they help create the right situation. This can take the form of an edible gift delivered to a client’s office that will be shared, a personal phone call when the client is socializing with friends, being visible where clients are socializing and buying a round of drinks, and the list of these nice little touches goes on and on.

The secret is for financial advisors not to depend on their emotional connection to activate conversations, but to look for ways to create the right situation where it’s natural for clients to talk about them.

Refine the Narrative: When people recommend service providers, they like to provide context.

At this stage, a financial advisor is putting the icing on the WOMI cake. They have emotionally connected, are able to activate client conversations, and now have reached the stage where they can help craft their client’s narrative.

This is not scripting clients, rather conversationally letting client’s know their back story; who they really are, what’s important outside the world of financial advice, why they got into the business, and so on. The idea here is to provide background that can be used when a client talks with someone else about their advisor.

Refining the narrative also includes helping clients articulate “why” they like working with their advisor. This requires clients to understand the value they’re receiving and are able to succinctly describe it to friend. This serves to stimulate why a person who might be listening should possibly meet this advisor.

Lastly, advisors need to educate clients on their ideal client profile. It’s much easier for clients to refer their advisor when they know the type of client they work with.

It’s important that financial advisors are subtle in this final stage of the Hierarchy of Word-of-Mouth Influence. Rather than telling clients what to say and when to say it, they need to plant seeds of their narrative in conversation. At this stage, the client is an advocate — the secret is allowing them to be themselves in conversation, but providing talking points that will refine the narrative.

Conclusion

This model provides a simple roadmap for financial advisors who are serious about benefitting from word-of-mouth-influence. All of which is simple, but not easy. Word-of-mouth influence is far more nuanced than any other marketing strategy, as there is not one direct cause and effect, but the impact on client acquisition is powerful. We’ll review this model and it’s impact next month at our Affluent Marketing Symposium. Make sure to register and join us on September 21 & 22.

Did you know you can get full access to 150+ of our exclusive articles PLUS our most popular webinar series on demand? Subscribe to our Course Library today!