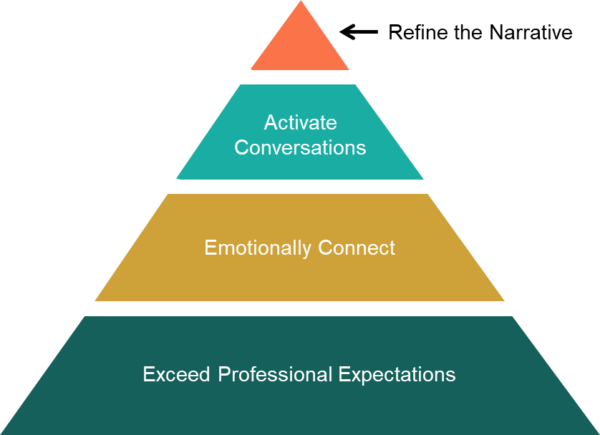

In a previous article I introduced the Word-Of-Mouth Influence (WOMI) Hierarchy™, explained how it evolved from 15 years of research, and provided a brief description of each component. In subsequent articles, I promised to take a deeper dive into each component, so the logical place to start is at the hierarchy’s foundation.

Exceeding professional expectations is the baseline requirement for WOMI. You need to think of it as the foundation of WOMI. But how does a financial advisor quantify “exceeding professional expectations”? Does this mean returning to the days where the promise of investment returns beating the market was the value proposition? Hardly!

What we’re talking about involves today’s affluent, what they are looking for in a financial advisor, and their perception of what they’re receiving. Translated, this means that every aspect of a financial advisor’s professional existence is relevant.

For the purpose of clarity, I’m going to segment WOMI’s foundation into three groups; personnel (financial advisor and staff), wealth management (advice, guidance, solutions provided — including outside experts), and service (personal and operational).

Personnel

The bulk of this grouping rests on the shoulders of the financial advisor. It’s important for the advisor to be extremely knowledgeable regarding the fluid nature of today’s financial landscape, general affluent expectations, and the specific needs and expectations of each client. In other words, total commitment to both their profession and their clients. In addition, it’s also important for their advisor to present his or herself in appearance, communication, and presence as a first-class professional. Similar standards apply to every team member, albeit to a slightly lesser degree. Everyone who interacts with affluent clients must be committed to their role (it’s more than just a job), be a true knowledge worker who can solve problems, be client friendly, and present themselves well.

Wealth Management

Today’s affluent want a solutions provider who can oversee the multidimensional aspects of their family’s financial affairs, which industry jargon has labeled comprehensive wealth management. Here’s where the advice, guidance, and recommendations must be tailored to each affluent client.

- All aspects of planning (financial goals, estate & trusts, retirement, college, taxes, health care) must be available and provided when needed.

- Portfolio management (investments meeting expectations), insurance solutions, banking services and any other financial issue an affluent client might have.

- Semi-annual or quarterly themed reviews where clients are able to review their current state of financial affairs, address a specific topic or theme, and have a clear understanding of their current financial picture.

- Outside experts vetted by the advisor (estate attorney, CPA, insurance specialist, banker, etc.); taking the lead in specific areas on an “as needed” basis; advisor attends every meeting with outside experts.

Service

There are two aspects of service that are critical to exceeding affluent expectations. First, every interaction — communication, response to requests, etc. — must be personal. Today’s affluent pick-up on pseudo-personalized service quickly, and when they do, it can taint the professional relationship. The second aspect of service involves operational efficiency; zero mistakes. Granted, the affluent understand that an occasional mistake will happen, but mistakes need to occur few and far between. Too many mistakes breed an annoyed client, and an annoyed client is no longer a loyal client.

This is why we refer to service in terms of being Ritz-Carlton quality and operations being at the standard of FedEx efficiency. One of the most frequent complaints our research continually uncovers involves communication. In general, affluent clients don’t feel their advisor is in close enough communication with them. This could be attributed to advisors over-reliance on mechanical communication (newsletters, research reports, etc.), but lack of a clear service model for top tier clients tends to create a grey area regarding personal client communication. Grey areas are never good.

When an advisor falls short regarding personal communication, positive word-of-mouth-influence will be non-existent. Because this issue is of such importance, we created a Communication Agreement for our coaching clients to use with their affluent clients. In this document every aspect of communication is spelled out, agreed upon, and then signed off on by both advisor and client. The objective is to establish the context for healthy two-way communication.

It’s important to understand that addressing the aforementioned is merely the foundation of the WOMI hierarchy. At this stage affluent clients aren’t likely to spread the good word on behalf of their financial advisor because, in their mind, this professional is doing what they’ve been hired to do. Right or wrong, affluent clients rarely give kudos for being a first-class professional. It’s expected.

That said, once an advisor masters the foundation of the WOMI Hierarchy, they’ve set the stage to create an ideal client — to connect on an emotional level — which I’ll cover in the next article.

Did you know you can get full access to 150+ of our exclusive articles PLUS our most popular webinar series on demand? Subscribe to our Course Library today!